Federal Reserve Z.1 data show that the net worth of the household and nonprofit sector (HNPS) reached a new record of $168.8 trillion in 2024Q3, eclipsing the previous record of $164 trillion set in 2024Q2. Bloomberg, Marketplace, and InvestmentNews all reported that higher real estate and stock prices drove household wealth to a new record level, echoing prior stories by Bloomberg and Reuters that heralded the second-quarter estimate of $164 trillion as a new record.

While the financial press celebrated record household wealth, contemporaneous survey results found that households were having trouble covering expenses. A 2024 Philadelphia Federal Reserve survey (PDF) found that a larger share of households in all income and age groups were worried about their ability to pay their bills, including households with income over $150,000. These findings echoed those of a Consumer Financial Protection Bureau’s 2024 survey, “Making Ends Meet”:

Overall financial stability and well-being deteriorated from 2023 to 2024. The deterioration occurred across demographic groups and measures. … More households had difficulty paying bills or expenses.

This apparent contradiction can be reconciled by recognizing that there is a difference between estimates of HNPS net worth and the net worth of households, and this difference has grown over time. Moreover, HNPS net worth is measured in current dollars and fails to account for inflation, which has significantly diminished households’ real net worth. Adjusting HNPS net worth estimates for these factors, I estimate that inflation-adjusted household wealth peaked in 2021, before households spent their COVID relief payments and inflation diminished the real value of their savings.

What factors skew the HNPS data away from reflecting American households’ real net worth?

Household and Nonprofit Sector Net Worth

According to the Federal Reserve (PDF),

The households and nonprofit organizations sector is comprised of individual households (including farm households) and nonprofit organizations such as charitable organizations, private foundations, schools, churches, labor unions, and hospitals. The sector is often referred to as the “household” sector, but nonprofit organizations are included because complete data for them are not available separately.

Net Worth Estimates of the Nonprofit Sector

Internal Revenue Code (IRC) section 501(c)(3) exempts from federal income tax the revenues of organizations engaged in religious, charitable, scientific, literary, or educational activities. Organizations that are exempt from taxes under IRC code 501(c)(3) must file IRS form 990 or 990-EZ annually. State chartered credit unions are tax exempt and must file annual IRS Form 990 or 990-EZ. Churches, religious organizations, federally chartered credit unions and section 501(c)(3) tax exempt organizations with annual revenues under $25,000 are tax exempt and exempt from the annual filing requirement.

Because of data limitations, the Federal Reserve historically has not produced separate estimates for the household and nonprofit sectors in its quarterly Z.1 statistics. In 2018, the Fed started providing supplemental annual estimates of the aggregate balance sheet for the nonprofit sector for years beginning in 1987. According to the Fed’s most recent estimate, the net worth of the nonprofit sector was about $10.7 trillion as of year-end 2023.

Net Worth Estimates of Private Investment Funds

According to the Fed’s Enhanced Financial Accounts,

The hedge funds sector has not been fully incorporated in the regular Financial Accounts publication… the assets of domestic hedge funds are usually assigned to the household sector…

The Fed’s Enhanced Financial Accounts discuss aggregate hedge fund balance sheets. However, the Fed’s HNPS Z.1 estimates include all private investment funds’ assets and liabilities in its estimates of the HNPS balance sheet. The US Securities and Exchange Commission (SEC) recognizes hedge, private equity, securitized asset, real estate, liquidity, venture capital and other special investment purpose funds as private investment funds.

Private funds are exempt from SEC regulations that apply to mutual fund and other institutional fund managers. While private funds are not required to publicly disclose their portfolio holdings or prepare annual or semi-annual public reports describing their performance, the Dodd-Frank Act required all private fund advisors who manage more than $150 million in assets to provide confidential disclosures to the SEC on Form PF.

Beginning in 2013, the SEC began publishing quarterly estimates of aggregate private fund data collected from Form PF. I use the SEC’s estimate of total private fund net assets, also called assets under management (AUM), as an estimate of the net worth of private investment funds. As of 2024Q1, the last data available, the SEC reports that private funds filing Form PF had more than $15 trillion AUM.

A study by the Office of Financial Research [Barth, Joenvaara, Kauppila and Wermers (2021)] compared SEC Form PF hedge fund data with hedge fund data compiled by several commercial vendors. Advisors of smaller private funds are not required to file Form PF. Using SEC Form PF and vendor data, the study estimated total hedge fund AUM to be roughly $5 trillion in 2016, of which about $3.5 trillion were reported to the SEC on Form PF. These results suggest that significant AUM balances are likely omitted from the SEC industry total AUM figures.

Household Net Worth Adjusted for Inflation

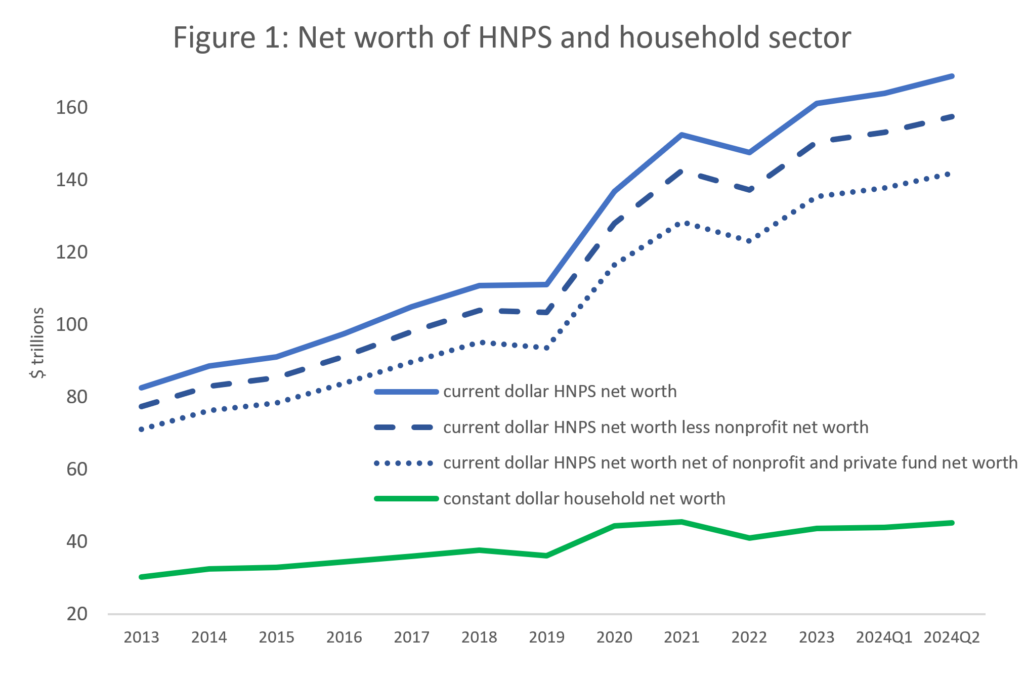

Estimates of HNPS, the nonprofit sector and private funds respective net worths are measured in current dollars whereas the real consumption value of household wealth depends on the price level. To estimate the real consumption value of household wealth, I adjust current dollar estimates of household net worth for the impact of consumer price inflation using the CPI for all urban consumers (1982-1984=100). Figure 1 shows end-of-year Fed Z.1 estimates of current dollar HNPS net worth, the adjustments made to arrive at current dollar estimates of household net worth, and the estimated value of constant dollar (inflation-adjusted) household net worth.

Current dollar household net worth is constructed as the Fed’s estimate HNPS net worth, less the Fed’s estimate of the nonprofit sector net worth, less private investment fund total AUM as reported by the SEC. The estimates use Fed and SEC year-end data from 2013 through 2023. The chart also includes two quarterly estimates for 2024Q1 and 2024Q2 each of which includes at least one component that is extrapolated using prior quarter relationships in the data.

The 2024Q1 estimate uses the SEC 2024Q1 private funds estimate of $15.1 trillion AUM. The Fed does not publish quarterly estimates for the net worth of the nonprofit sector. I use the 2023 estimated nonprofit sector share of HNPS net worth (6.62 percent), the 2024Q1 HNPS net worth estimate ($164 trillion) to estimate nonprofit net worth for 2024Q1 at $10.9 trillion. Subtracting $26 trillion in aggregate nonprofit and private fund net worth from HNPS net worth yields $137.8 trillion as the 2024Q1 estimate of household sector net worth.

The Fed estimates 2024Q2 HNPS net worth to be $168.8 trillion. In 2024Q1, the SEC’s private fund AUM estimate accounted for 9.3 percent of HNPS net worth. Using this share, in total, I estimate that nonprofit and private funds account for 15.92 percent of 2024Q2 HNPS net worth which implies 2024Q2 household net worth of $141.9 trillion. Household net worth estimates are upward biased to the extent that SEC aggregate private fund AUM estimates are understated.

According to these estimates, constant dollar household net worth peaked in 2021, before households exhausted their government COVID stimulus payments and accelerated inflation depreciated their savings. The estimated current dollar value of household net worth was higher in 2024Q2 than at 2021 year-end ($141.9 trillion vs. $128.5 trillion). However, the gain in net worth measured in current dollars was more than offset by CPI inflation. In inflation-adjusted terms, household net worth was $45.5 trillion at year-end 2021 compared to $44 trillion in 2024Q1 and $45.2 trillion in 2024Q2.